Pandeng Zhang, Senior Analyst for China Automotive Supply Chain & Technology Forecasts at IHS Markit, shares the company’s analysis on the surge in electric vehicle uptake in the country and future predictions for growth.

From 2009 to 2018, driven by a strong policy stimulus, China’s new energy vehicles (NEVs) have achieved rapid growth from less than 10,000 to more than 1,200,000 units. It has become the world's largest NEV market for five consecutive years since 2015. However, 2019’s production and sales volume of circa 1.2 million vehicles remained unchanged from the year prior.

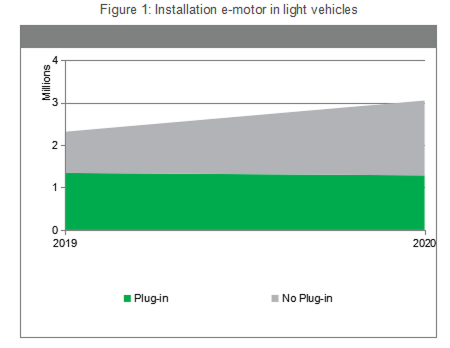

As an important feature of vehicle electrification, the role of the internal combustion engine as a source of the driving force is partially or completely replaced by an electric motor. The market for electric drive systems has seen a corresponding rapid growth to that of the NEV market. In 2019, the total installed number of electric motors in light vehicles in China was 2.3 million, of which 1.3 million were installed in plug-in vehicles and the remaining for non-plug-in hybrid vehicles.

Taking into account the impact of COVID-19, both the sales volume of light passenger vehicles and the production output of the vehicle model development schedule, IHS Markit has made a forecast of 13-14% negative growth for the China light vehicle market in 2020.

Correspondingly, the installed volume of electric motors in NEVs is expected to record negative growth of about 60,000 units. But this value will be lower than the decline in the production volume of NEVs because the penetration of pure electric four-wheel-drive models has increased the installation volume of motors.

The installation volume of non-plug-in hybrid models will dramatically increase to 1.8 million units versus the near one million volume of 2019, pushing the electric motor market to positive growth of more than three million units.

The growth of hybrid models will occur as a result of the tightening of the corporate average fuel consumption (CAFC) target in 2020 as well as the implementation of HEV product offensives by Japanese vehicle manufacturers, such as Toyota and Honda.

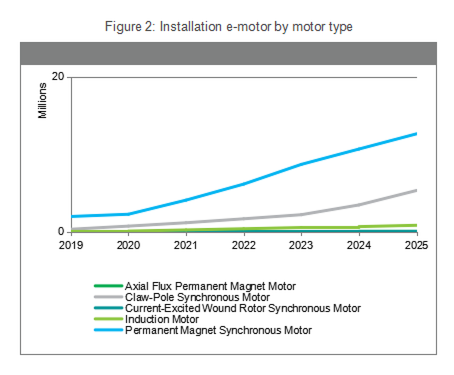

Regarding the motor type in China, high-voltage electric motors mainly include permanent magnet synchronous motors and asynchronous induction motors, with the former accounting for more than 90% of market share. In the low-voltage mild hybrid market, claw pole synchronous motors are widely used for 48V belt-driven starter generator applications.

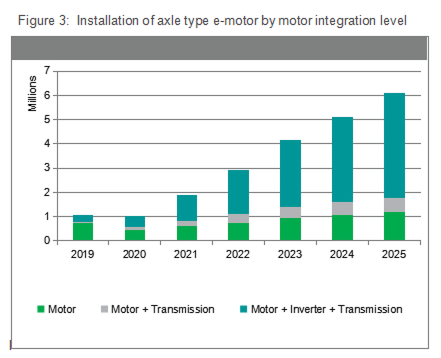

There is a growing trend in building a three-in-one electric drive system for e-axle type electric motors, which integrates the motor, inverter, and transmission into a unified assembly to achieve the benefits of a lightweight, high-efficiency and compact design. This three-in-one electric drive unit, usually named as e-Axle, can provide a wide power range, which varies from 50 to 300kW. Output torque at the wheel level is between 1000 and 6000Nm which, when geared, can meet the flexible arrangement of both front and rear drives. At present, most of the e-Axles use single-speed reducers and offset concentricity layout, while the next-generation coaxial and two-speed or continuously variable transmissions are currently under development.

In 2020, the electric drive system in the China market has already entered a stage of fierce competition. There are many motor manufacturers on the market that can be categorized broadly into four groups: 1) In-House Car Manufacturers or component segments such as Tesla, Volkswagen, BYD, Nio XPT, BAIC BJEV, SAIC HASCO, Great Wall HYCET, etc. 2) Foreign, Tier-One Component Suppliers such as Bosch, BorgWarner, Valeo Siemens Automotive, Nidec, Magna, ZF, LG Electronics, GKN, Vitesco Technologies, etc. 3) Local, Independent Motor Suppliers such as Jing-Jin Electric, Inovance, Edrive, JEE, Founder Motor, Greatland Electrics, etc. 4) New Entrant such as Huawei.

As the subsidies recede, the cost pressure brought by finer margins to the OEM is transmitted to the component supply chain. The current pricing structure of electric drive systems is under ever-greater pressure, and the entire market needs to rely on increasing scale to achieve profitability.

The three-in-one drive form mentioned above has also spawned new market participants, acting as e-motor design parents and system integrators. Compared with individual component suppliers, these two players will have a closer relationship with OEMs.

Design parents with core technology and IP can be loosely divided into two categories: 1) OEM R&D or 2) Suppliers. For individual component suppliers, including motor, inverter, and transmission, OEM in-house design e-Axle projects will be the main target in the future. For system suppliers, their electric drive system solutions need to either provide a performance or efficiency advantage but also provide a competitive price to win the bid. Component suppliers have shown willingness to improve system development capabilities and achieve scale by merger, acquisition, reorganization, or cooperation with other market players before increasing the premium price of electric drive products.

In summary, although the COVID-19 pandemic has a highly significant negative impact on the entire automotive market, the trajectory growth of the electric drive market in 2020 is unchanged. The industry ‘direction of travel’ is set. it will be a market with high growth potential for a long time to come. Players in this market will further increase, covering more OEMs and suppliers.

IHS Markit forecasts that the revenue opportunity of the Chinese e-motor market will grow rapidly from at least $1.5 billion in 2020 to $9.4 billion in 2025.

About the Author

Pandeng Zhang

Senior Analyst, China Automotive Supply Chain & Technology Forecasts, IHS Markit

Mr. Zhang has over 7 years’ experience in the Automotive Industry. He was with Bosch for 5 years before joining IHS Markit as a Senior Engineer in the Research & Development department, during which he had a 6-month assignment to Bosch Engineering Germany in 2014. Mr. Zhang has intensive research into China New Energy Vehicle market development and forecast, specializing in the E-Mobility domain, including vehicle electrification, internal combustion engine, E-Motor, battery, and power electronics components. Mr. Zhang focuses on the research of market size and development trends about EV charging infrastructure and wireless charging technology. Mr. Zhang has an engineering bachelor from Hunan University, major in Thermal Energy and Power Engineering.